News

AM EINVOICE – FULLY UPGRADED IN ACCORDANCE WITH DECREE 70/2025/NĐ-CP

Kojinyoung

May 29, 2025

78

AMnote is pleased to announce that its AM eInvoice system has been fully upgraded to comply with the latest requirements under Decree 70/2025/NĐ-CP, which amends and supplements Decree 123/2020/NĐ-CP. The upgraded system is now ready to assist businesses in issuing tax invoices and related documents...

Read More

OFFICIAL RESOLUTION TO REDUCE VAT BY 2% IN THE FIRST 6 MONTHS OF 2025

Kojinyoung

December 26, 2024

376

The National Assembly has agreed to reduce VAT by 2% for the first 6 months of 2025, from January 1, 2025 to June 30, 2025 in Resolution 174/2024/QH15. Accordingly, Section 8 of Resolution 174/2024/QH15 specifically states: Continue to reduce 2% of value added tax rate...

Read More

TAX RATES FOR IMPORTED GOODS AND WHERE TO PAY VALUE ADDED TAX (VAT) ON IMPORTS?

Kojinyoung

October 30, 2024

163

We would like to provide information on the tax rates and where to pay Value added tax(VAT) payment for imported goods as follow. *What is the VAT for Imported Goods? According to Article 8 of the 2008 Value Added Tax Law, there are currently 3...

Read More

AM-Einvoice, Directly Connected to Lazada, Shopee and Tiktok

Kojinyoung

October 17, 2024

593

Our electronic invoice program AM-Einvoice has added a function to directly import sales data from Customers’ Lazada, Shopee and Tiktok shop accounts to issue electronic invoices immediately. We hope Customer will use it a lot. For inquiries and consultation: Email: manager@amnote.com.vn – amteam@amnote.com.vn Phone: 09...

Read More

CONTINUE TO REDUCE BY 2% VAT UNTIL THE END OF JUNE 2024

Kojinyoung

January 25, 2024

242

On November 29, the National Assembly agreed to reduce by 2% VAT from January 1, 2024 to June 30, 2024. 1. TYPES OF GOODS AND SERVICES THAT ARE ELIGIBLE FOR VAT REDUCTION AND NON-REDUCTION Based on Clause 1, Article 1 of Decree 94/2023/ND-CP, the 2%...

Read More

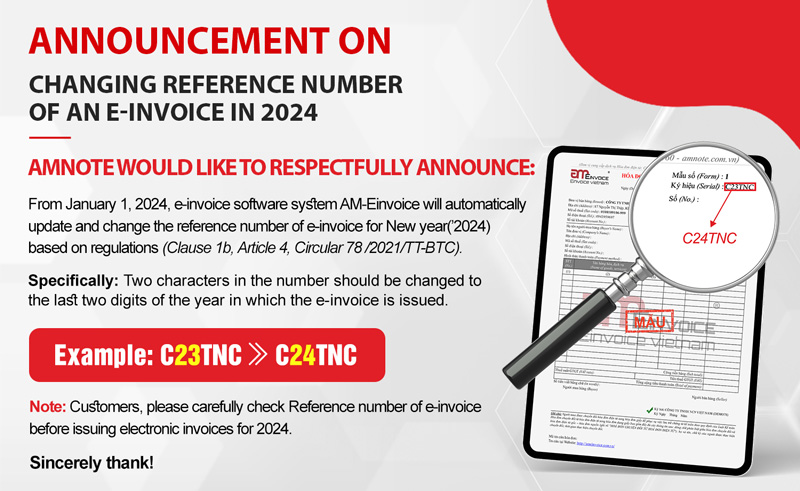

ANNOUNCEMENT ON CHANGING REFERENCE NUMBER OF AN E-INVOICE IN 2024

Kojinyoung

December 27, 2023

433

AMnote would like to respectfully announce: From January 1, 2024, e-invoice software system AM-Einvoice will automatically update and change the reference number of e-invoice for New year(’2024) based on regulations (Clause 1b, Article 4, Circular 78 /2021/TT-BTC). Specifically: Two characters in the number should be...

Read More

REGULATIONS ON E-INVOICE FORMAT ACCORDING TO DECREE 123/2020/ND-CP

Kojinyoung

December 19, 2023

383

1. WHAT IS E-INVOICE FORMAT? Based on Clause 1, Article 12, Decree 123/2020/ND-CP, The e-invoice format is the technical standards for type of data, length of data of information fields serving transmission, storage and display of e-invoices. E-invoices shall be XML documents (eXtensible Markup Language),...

Read More

THINGS NEED TO NOTICE WHEN USING E-INVOICES GENERATED FROM POS CASH REGISTER

Kojinyoung

November 29, 2023

370

1.CONDITIONS TO APPLY E-INVOICES GENERATED FROM POS CASH REGISTER Based on guidance in Section 3 of Official Letter 15461/CTTPHCM-TTHT in 2022, the conditions for applying e-invoices generated from POS cash registers include: Being able to transact with the tax authority by electronic means (such as...

Read More

HANDLING OF ERRONEOUS E-INVOICES ACCORDING TO OFFICIAL DISPATCH 1647/TCT-CS 2023

Kojinyoung

October 24, 2023

617

1. REGARDING HANDLING OF ISSUED ERRONEOUS E-INVOICES Official Dispatch No. 1647/TCT-CS dated May 10, 2023 on handling of erroneous e-invoices has instructions as follows: “Based on the provisions in Point b, Clause 2, Article 19 of Decree No. 123/2020/ND-CP and Points c and e, Clause...

Read More

REGULATIONS ON THE TIME OF ISSUING AND SIGNING E-INVOICES IN 2023

Kojinyoung

September 19, 2023

821

I. REGULATIONS ON THE TIME OF ISSUING INVOICE BY TYPE OF BUSINESS Sale of goods: Based on Clause 1, Article 9 of Decree No. 123/2020/ND-CP, Invoices for sale of goods (including the sale of state-owned property, property confiscated and put into state fund, and the...

Read More

Tiếng Việt

Tiếng Việt 한국어

한국어