AMnote is pleased to announce that its AM eInvoice system has been fully upgraded to comply with the latest requirements under Decree 70/2025/NĐ-CP, which amends and supplements Decree 123/2020/NĐ-CP. The upgraded system is now ready to assist businesses in issuing tax invoices and related documents in full compliance with current laws. The system has standardized…

The National Assembly has agreed to reduce VAT by 2% for the first 6 months of 2025, from January 1, 2025 to June 30, 2025 in Resolution 174/2024/QH15. Accordingly, Section 8 of Resolution 174/2024/QH15 specifically states: Continue to reduce 2% of value added tax rate for groups of goods and services specified in Point a,…

We would like to provide information on the tax rates and where to pay Value added tax(VAT) payment for imported goods as follow. *What is the VAT for Imported Goods? According to Article 8 of the 2008 Value Added Tax Law, there are currently 3 VAT rates: 0%, 5%, and 10%. Specifically, according to Circular…

Our electronic invoice program AM-Einvoice has added a function to directly import sales data from Customers’ Lazada, Shopee and Tiktok shop accounts to issue electronic invoices immediately. We hope Customer will use it a lot. For inquiries and consultation: Email: manager@amnote.com.vn – amteam@amnote.com.vn Phone: 09 2121 9000 (Vietnamese) – 07-8888-1000 (Korean) Website: www.ameinvoice.com / Kakao…

On November 29, the National Assembly agreed to reduce by 2% VAT from January 1, 2024 to June 30, 2024. 1. TYPES OF GOODS AND SERVICES THAT ARE ELIGIBLE FOR VAT REDUCTION AND NON-REDUCTION Based on Clause 1, Article 1 of Decree 94/2023/ND-CP, the 2% reduction in VAT will be applied to groups of goods…

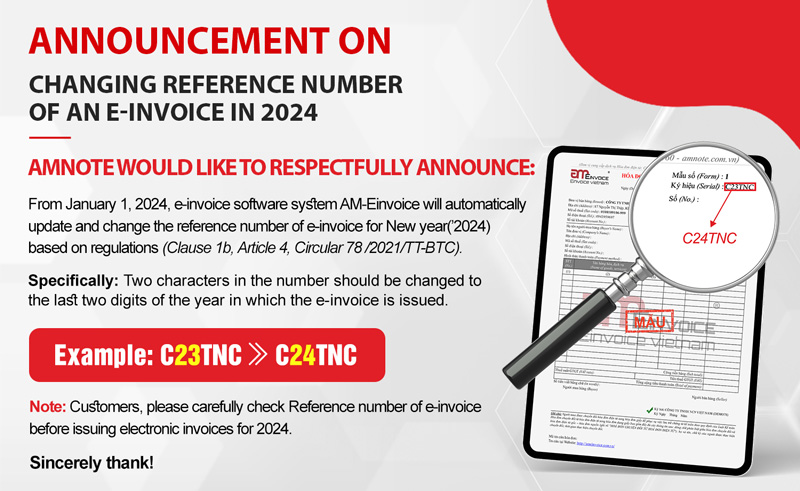

AMnote would like to respectfully announce: From January 1, 2024, e-invoice software system AM-Einvoice will automatically update and change the reference number of e-invoice for New year(’2024) based on regulations (Clause 1b, Article 4, Circular 78 /2021/TT-BTC). Specifically: Two characters in the number should be changed to the last two digits of the year in…

1. WHAT IS E-INVOICE FORMAT? Based on Clause 1, Article 12, Decree 123/2020/ND-CP, The e-invoice format is the technical standards for type of data, length of data of information fields serving transmission, storage and display of e-invoices. E-invoices shall be XML documents (eXtensible Markup Language), which are meant to share electronic data between IT systems…

1.CONDITIONS TO APPLY E-INVOICES GENERATED FROM POS CASH REGISTER Based on guidance in Section 3 of Official Letter 15461/CTTPHCM-TTHT in 2022, the conditions for applying e-invoices generated from POS cash registers include: Being able to transact with the tax authority by electronic means (such as a digital signature registered with the tax authority to be…

1. REGARDING HANDLING OF ISSUED ERRONEOUS E-INVOICES Official Dispatch No. 1647/TCT-CS dated May 10, 2023 on handling of erroneous e-invoices has instructions as follows: “Based on the provisions in Point b, Clause 2, Article 19 of Decree No. 123/2020/ND-CP and Points c and e, Clause 1, Article 7, Circular No. 78/2021/TT-BTC. Based on Decision No….

I. REGULATIONS ON THE TIME OF ISSUING INVOICE BY TYPE OF BUSINESS Sale of goods: Based on Clause 1, Article 9 of Decree No. 123/2020/ND-CP, Invoices for sale of goods (including the sale of state-owned property, property confiscated and put into state fund, and the sale of national reserve goods) shall be issued when the…

Tiếng Việt

Tiếng Việt 한국어

한국어